Nigeria population is estimated over 230 million as of 2019. This makes Nigeria the most populous country in Africa and the world’s sixth most populated country in the world. Nigeria economy is the largest in Africa, the 31st-largest in the world by nominal GDP, and 26th-largest by PPP. Nigeria is highly endowed in natural resources such as crude oil, tin, lead, coal, cocoa, limestone, palm amongst others. Nigeria is also members of international bodies and organization such as The United Nations (UN), African Union (AU), Economic Community of West African States (ECOWAS), Organization of Petroleum Exporting Countries (OPEC), amongst others.

From what is stated above, you can’t but agree that Nigeria is the Giant of Africa. However, with such an economic crisis,the regular increase in the rate of inflation, ravishing poverty, unemployment, energy crisis, high rate of corruption, we cannot refer to Nigeria as being the Giant of Africa.

Going straight to the point, we are going to analyze the factors which are unfavorable to the economy of Nigeria, which are :(1) Inflation (2) Cost of Energy (3) Brain Drain (4)The borrowing spree in Nigeria.

(1) Inflation

Inflation is the general increase in price and the fall in the purchasing value of money. According to Statistics, the inflation rate increased by 0.18 percent compared to the rate of March 2023. Also, the headline inflation rate in March 2023 was 5.40 percent higher than the rate recorded in April 2022, which was at 16.82 percent. The Central Bank of Nigeria (CBN) has been unable to maintain the rate of inflation to the target range of 6.0 – 9.0 percent. On the other hand, inflation deters foreign direct investments (FDI) because of the uncertainty in the value of the money as a result of continuous devaluation, low purchasing power and low return in profit. This is because of the increase in the price of goods and services needed for production. Inflation can be caused by different factors, which are excessive government expenditures, borrowing from international bodies to finance a deficit budget, high level of consumption from the part of the citizens and scarcity of goods to meet the ever increasing demands.

(2) Cost of Energy

Nigeria is the 15th largest producer of petroleum in the world, the 6th largest exporter and has the 9th proven reserves. Petroleum plays a large role in the Nigeria economy and politics accounting for about 80% in of government earnings. Nigeria also has the 9th largest proven natural gas reserves estimated by OPEC; the government value of its about 206.53 trillion cubic feet and has been valued at $803.4 trillion. Natural gas is seen as having the potential to unlock an economic miracle in the Niger River . Nigeria each year losses to gas flaring an estimate of $2.5 billion, and over 120,000 barrels of oil per day to crude theft in the Niger Delta, it’s main producing oil region in Nigeria. This has lead to priracy and conflict for control in the region and also led to disruption in production. However, coal, petroleum reserve, natural gas, peat, hydroelectricity, solar and wind are major sources of energy in Nigeria and the country remains a top producer of crude oil and natural gas in Africa. It’s production as recorded in 2002, averaged 1.2 million barrels of oil per day (bpod). Despite the mining of crude oil in Nigeria, the cost of purchasing it is exorbitant as a result of the lack of refineries in Nigeria. It is unbelievable that we export our crude oil in Nigeria but shipped to be refined in foreign countries. Nevertheless, Nigeria energy sector is still subsidized by the govt to enable the masses to afford them. The new administration of President Bola Tinubu has signalled a policy intention to scrap the costly 7 trillion naira or 15.1 billion dollars petroleum subsidy regimen. Companies in Nigeria have raised concerns about their inability to manage high energy price and their limited capacity to pass the burden down to the customers. According to reports, the cost of energy has significantly increased the operation expenses in the production process of companies such as Dangote Cement Plc., BUA Cement Plc., GlaxoSmithKline Plc., Cutix Nigeria Plc. and Academy Press Plc, etc.

Nigeria has always experienced irregular supply of electricity with, recently growing increase in receipts. This has adversely affected the cost of production in Nigeria. Notwithstanding, the high cost of electricity, supply gaps remain huge with the power sector unable to meet the 5,000 megawatts supply limit, with many Nigerian firms and citizens paying the estimated bills for unavailable electricity and further depending on generating sets for household and commercial use. Nigeria will definitely experience serious problems with the cost of energy riding to over 70% as purchasing power remains a challenge in the face of unemployment and poverty. According to reports, the available electricity on the grid stood at 3,057.7 MW from 17 power plants, with the 1,942.3 MW difference pending. With the question of affordability emerging as a major consideration as the grid remains unrealiable, stakeholders have expressed fear that Nigerian Electricity supply market may face tougher times managing outlook due to apathy that may come from customers who are losing faith in the system and may resort to alternate energy, forcing it to make losses. Sta Also, there is also an expected 40% increase in the tarrifs of electricity due as of June 1.

(3) Brain Drain

Brain Drain involves the migration of skilled workers out of their countries to more developed countries in search of better working experience, wage and opportunities. This has occurred since the late 80’s till date. Brain drain is dominant in Nigeria as the mass exit from Nigeria is caused by high level of insecurity, unemployment, infrastructural deficit, hunger and failure from the various level of government to provide opportunities for the youths to live their best desired lives. From case studies, many young and old Nigerians afe bent on leaving the country and through a report, in 2016 alone, 36,00 Nigerians arrived Europe through water and the number of Nigerians granted work permit in the UK increased from 3,918 in 2019 to 15,772 in 2022. The consequence of on an already devastated economy of Nigeria is loss of tax revenue, loss of potential future entrepreneurs, a shortage of skilled workers, a loss of confidence in the economy of Nigeria by foreign and local investors, reduction in the market population and increase in the supply of labour in all sectors of the economy.

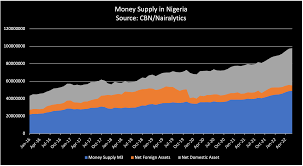

(4) The Borrowing Spree in Nigeria

Borrowing allows the government to raise funds to spend on public services and projects than they can raise in taxes. The Nigerian government often borrow to bridge the gap in the deficit budget caused as a result of low revenue generated by the government. Nigerian public debt has been on the rise despite securing debt relief during the Olusegun Obasanjo administration, successive governments, however, have continued on the borrowing spree with the federal government’s component of the public debt(local and foreign) climbed from N3.5 trillion in 1999 to N26.9 trillion at the end of March 2019, according to data from DMO.This has raised concern among Nigerians on the debt sustainability of the country and the dwindling revenue to meet the debt obligation to the creditors. The effects in borrowing is that it leads to inflation, higher debt interest payment, over taxation of firms and citizens to fund the payment of the debt.

In conclusion, Nigeria is facing a depreciating economy and it is up to the administration of President Bola Tinubu to put the economy and country back on track as the Giants of Africa.

DELTA STATE UNIVERSITY, OLEH CAMPUS

FACULTY OF LAW, DEPARTMENT OF JURISPRUDENCE AND INTERNATIONAL LAW