The Central Bank of Nigeria is now working with commercial banks to clear $10 billion foreign exchange (forex) backlog within the next two weeks.

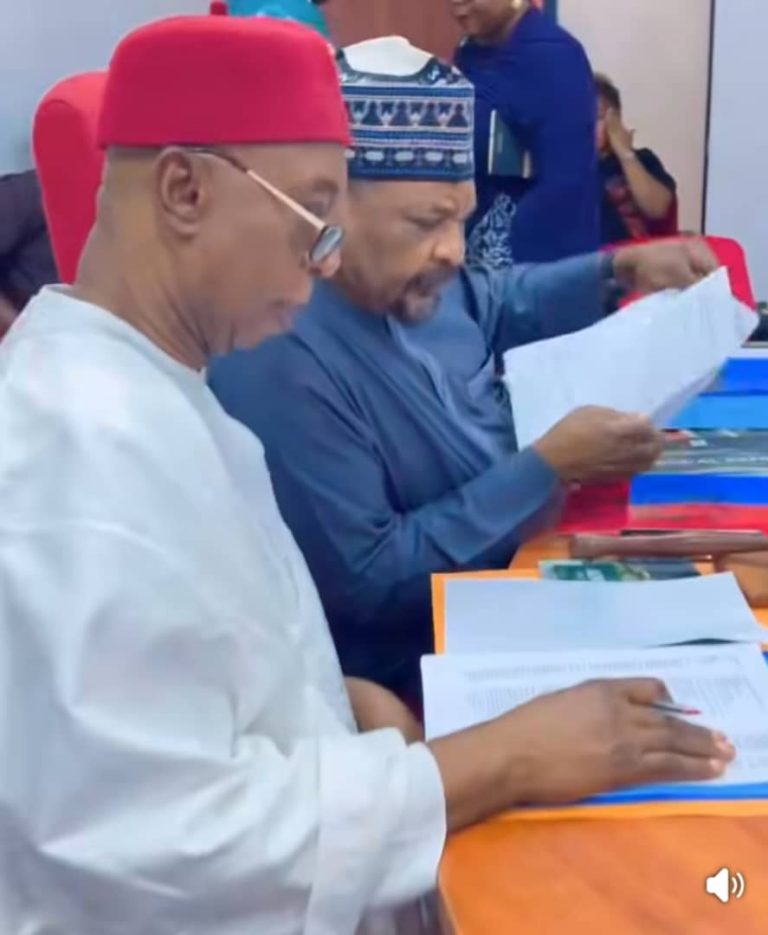

Acting Governor Folashodun Shonubi who disclosed this at a forum in Lagos on Tuesday, September 5, said the backlogs would be cleared through different structures within the forex market.

Shonubi said the banks who control 75 per cent of the forex transactions, will play significant role in seeing that the backlog are cleared.

The backlogs, estimated at about $10 billion, include dollar requests from manufacturers and importers purchasing raw material inputs from abroad, parents paying their children’s tuition fees abroad, Nigerians paying medical bills abroad, travellers sourcing Business Travel Allowances (BTAs) and Personal Travel Allowances (PTA), among others.

These requests were stalled for years due to dollar scarcity, drop in foreign direct investments (FDIs) and foreign portfolio investments (FPIs) inflows, drop in foreign reserves positions amongst other offshore investment opportunities.

Shonubi said the local banks have been working with the apex bank on various structures to clear it. He said;

“As matter of fact, there is a large amount of the obligations that the banks in Nigeria have already taken on. So, what happened was that at maturity, they actually make the foreign exchange available for those who needed to use them like importers and what have you.

“There are some customers who still have their obligations and part of the restructuring with the banks in Nigeria, is also to clear that backlog. That is something we have been discussing for a while. I expect that we will do that, within the next one or two weeks.

“What that means, therefore, is that this obligation that people keep on talking about will not be left. Today, we still intervene in the market, so it is not as if it has affected our ability to make monies available to banks in the Investors and Exporters foreign exchange market.

“When we look at the volumes, the Central Bank of Nigeria today contributes less than 25 per cent into the forex market. And the aim if you remember about a year and a half ago, was that the Central Bank did not want to be a regular player, but more of intervening to stabilise the rates and that is where we are going.

“There are so much more foreign exchange that people don’t talk about, that is being made available through the banking system and banks are selling to their customers. It doesn’t come to the Central Bank, it doesn’t appear as part of the demand that comes to us. And it is significant. It is almost three times what we as a Central Bank make available.”

On claim of CBN owing JP Morgan $7 billion forex forwards, Shonubi said;

“I think you have misinformation. There is no outstanding $7 billion with JP Morgan in any form. It was based on the opinion that was put on paper and everybody jumped on it.”