The exchange rate between the naira and dollar opened the week at N1,200/$1 on P2P platforms on Monday, Oct. 23.

The implication of this is that the naira is 3.41 percent weaker than on Friday, Oct. 20, when it closed at N1,170 on the same market.

This week, on the black market where the exchange rate is sold unofficially, quotes are going for N1200/$1 for cash trades and N1,250-N1300 for wired transfers.

By the close of business on Monday, October 23, 2023, some traders quoted wired transfer rates at about N1300/$1 while cash transactions were being quoted for N1,240. The P2P rate also closed the day at about N1220/$1.

Meanwhile, as the black market rates depreciate, the official rates gained on Monday, Oct, 23, closing at N793.34/$1 compared to N808/$1 reported at the end of last week.

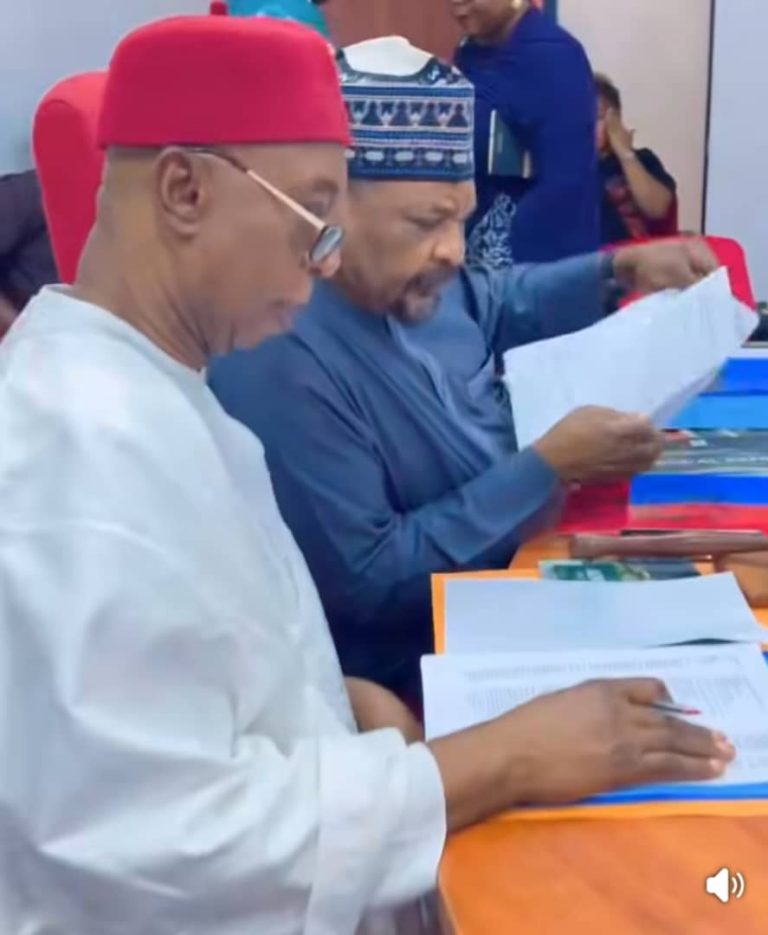

The minister of finance and coordinating the economy, Mr. Wale Edun said on Monday that around $10 billion of forex inflows is expected within weeks rather than months.

Speaking during a panel session at the ongoing Nigeria Economic Summit, he said: “In addition, from the supply of foreign exchange through NNPC, increased production, reduced expenditure, from transactions such as forward sales, from our discussions with sovereign wealth funds, that are ready to invest and provide advanced alongside that investment, there is a line of sight of $10 billion worth of foreign exchange in the relatively near future in weeks rather months.”