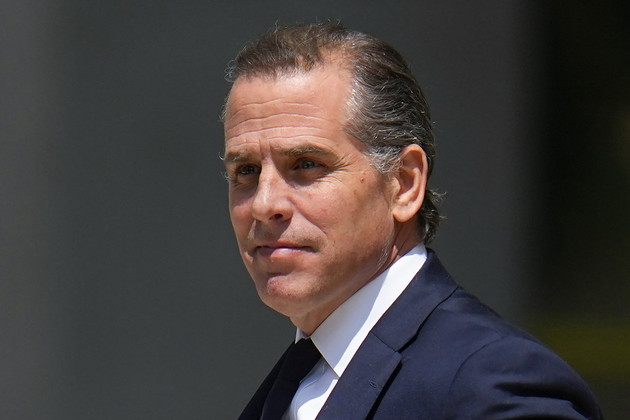

A federal grand jury in California has indicted Hunter Biden on nine charges, including three felonies, for failing to pay his taxes, understating his income, and exaggerating his expenses on tax returns between 2016 and 2019.

The president’s son could face two criminal trials next year as his father runs for reelection against Donald Trump, who himself is facing four criminal cases.

He is also facing separate criminal charges against him pending in Delaware for illegally possessing a gun.

The Hunter Biden cases were brought by special counsel David Weiss, the Delaware prosecutor who has long supervised the federal probe into the president’s son.

The new charges include tax evasion, filing false returns, failure to file returns on time, and failing to pay federal taxes. They carry a maximum possible prison term of 17 years, although defendants typically get shorter sentences under federal guidelines.

Each of the tax charges accuses Biden of acting “willfully,” something his defense is sure to contest since he has acknowledged struggling for years with drug addiction.

Prosecutors acknowledge those issues at points in the indictment, but say Biden spent lavishly on an “extravagant lifestyle” while shirking on his taxes, including paying for “drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing and other items of a personal nature.”

“[After] five years of investigating with no new evidence — and two years after Hunter paid his taxes in full — the U.S. Attorney had piled on nine new charges when he had agreed just months ago to resolve this matter with a pair of misdemeanours,” Hunter Biden’s attorney, Abbe Lowell, said in a statement. “I wrote U.S. Attorney Weiss days ago seeking a customary meeting to discuss this investigation. The response was media leaks today that these charges were being filed.”

The charges come amid an effort by House Republicans to link President Joe Biden to his son’s business dealings as part of an impeachment inquiry, though the inquiry has produced no evidence that the elder Biden took any actions as president or vice president to corruptly enrich his family.

The tax case has been years in the making. Hunter Biden’s financial dealings drew the attention of federal law enforcement in 2018. After years of investigation, Weiss, the Trump-appointed U.S. attorney for Delaware, considered bringing tax charges in California, where Biden lived when he allegedly failed to pay taxes. To do so, Weiss needed to partner with a federal prosecutor in California or receive special authority from the Justice Department.

In the fall of 2022, Weiss discussed partnering with Martin Estrada, the U.S. attorney for the Central District of California. But Estrada declined to “co-counsel” on the case, as he later told congressional investigators. Instead, Estrada said he offered Weiss office space and administrative support.

Several months later, Weiss’ team negotiated a plea deal with the president’s son that would have required him to plead guilty to two misdemeanour tax counts. In return, Biden would have been unlikely to face prison time on either the tax or gun charges and would have received protection from future criminal charges.

But after a federal judge pressed prosecutors and lawyers for Hunter Biden at a July hearing on details about the deal, it collapsed. Then, in August, Attorney General Merrick Garland made Weiss a special counsel, which formally empowered him to bring criminal charges anywhere in the country. In September, Weiss charged Hunter Biden in Delaware with owning a gun while being a drug user and lying on a form when he allegedly purchased that gun in 2018.

The charges Hunter Biden now faces are far more numerous and serious than the pair of misdemeanours he’d agreed to plead guilty to under the earlier deal.