In a major effort to reduce the cost of cooking gas, Nigeria’s Federal Government has eliminated VAT and customs duty on imported liquefied petroleum gas (LPG). This policy is expected to significantly lower cooking gas prices nationwide.

Background of the Decision:

According to a report by The Cable, this decision by the federal government is aimed at reducing the market prices of cooking gas, thereby promoting clean cooking practices and increasing the supply to meet local demands.

The Ministry of Finance communicated this new policy through a letter dated November 28, 2023, which was addressed to various key officials, including the Special Adviser to the President on Energy, the Comptroller-General of the Nigeria Customs Service (NCS), and the Chairman of the Federal Inland Revenue Service (FIRS).

Contents of the Letter:

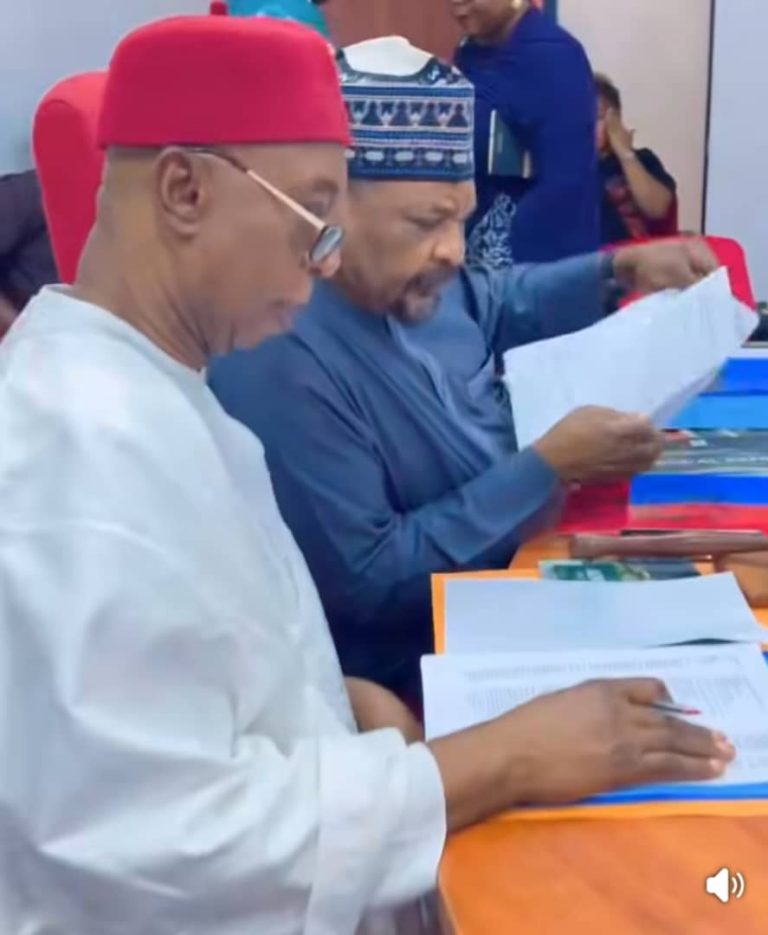

The letter, signed by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, underlines President Bola Tinubu’s commitment to improving Nigeria’s investment climate.

It reads: “In line with His Excellency, President Bola Tinubu’s commitment to improving the investment climate in Nigeria, increasing the supply of LPG to meet local demand, reducing market prices and promoting clean cooking practices, I hereby affirm Presidential directive dated July 29, 2022, with reference number PRES/88/MPR/99,”.

It further clarifies that the importation of LPG using specific HS Codes is exempt from Import Duty and VAT, effective immediately.

Directive to the Nigerian Customs Service:

Following this directive, the Nigerian Customs Service has been instructed to comply and withdraw all debit notes issued to petroleum marketers who have imported LPG since August 26, 2019.

Additional Items Exempted:

Besides LPG, other related items like LPG cylinders, gas leak detectors, steel pipes, valves, fittings, dispensers, gas generators, and LPG trucks are also exempted from VAT and duty payments.

Context Prior to the Decision:

This move comes after recent concerns raised by Ekperikpe Ekpo, the Minister for Petroleum Resources (Gas), about the soaring prices of cooking gas.

He highlighted the irony of Nigeria’s abundant gas reserves not adequately serving the domestic market and the urgent need for government intervention.

A team was constituted to address this issue and develop strategies to increase the availability and affordability of cooking gas in Nigeria.

Current Situation:

As of early December, the cost of refilling a 12.5kg gas cylinder in Abuja was around N11,800.

Notably, 40% of Nigeria’s cooking gas supply comes from the Nigerian Liquefied Natural Gas (NLNG) Limited, while the remaining 60% is imported.

The pricing of this essential commodity is influenced by the exchange rate of the Naira against the Dollar. With the current exchange rate at N1200 to a dollar on the black market, this policy change is timely and crucial.

Impact of the Decision:

The removal of VAT and customs duty on LPG imports is a strategic step to combat the rising costs of cooking gas in Nigeria.

It is anticipated that this policy will ease the financial burden on households and encourage the use of cleaner energy sources.

This decision not only addresses the immediate needs of the Nigerian populace but also aligns with global environmental goals by promoting cleaner cooking methods.