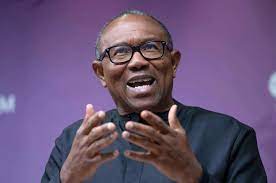

As the crisis on Foreign Exchange market continues in the country, the presidential candidate of Labour party in the 2023 election, Peter Obi, has said that the various attacks on Bureau de Change (BDCs) operators by security agents and EFCC operators across the country are ‘’ill-advised, wrongly directed and will further escalate and worsen the exchange rate situation in the country”

Obi stated this in a statement released today February 25.

‘’The recent reported attacks and disruption of the business activities of Bureaux de Change (BDCs) operators in different urban centers across the country by Government Agencies, are ill-advised and wrongly directed.

Rather than solve the problem, the action will further escalate and worsen the exchange rate situation in the country. The BDCs are not the primary suppliers of forex nor do they create demand. They only provide a market to sellers and buyers of foreign currency.

They are part and parcel of every economy and can be found even in the developed economies of the world. To think that the BDCs are the cause of the declining value of the Naira is a smack on rational economic thinking.

The only way to shore up the value of our currency is to move the country from consumption to production, especially export-led production, and fight corruption, which allows unproductive money to pursue the available supply of foreign currency.

As long as Nigeria remains an unproductive economy and corruption continues unfettered with people in possession of unproductive excess cash, the value of our currency will continue to depreciate.

It’s important therefore that government authorities properly understand the workings of a modern economy and channel their efforts accordingly.”