The federal government had debunked the claim of having plans to illegally access the pension fund to finance infrastructure projects.

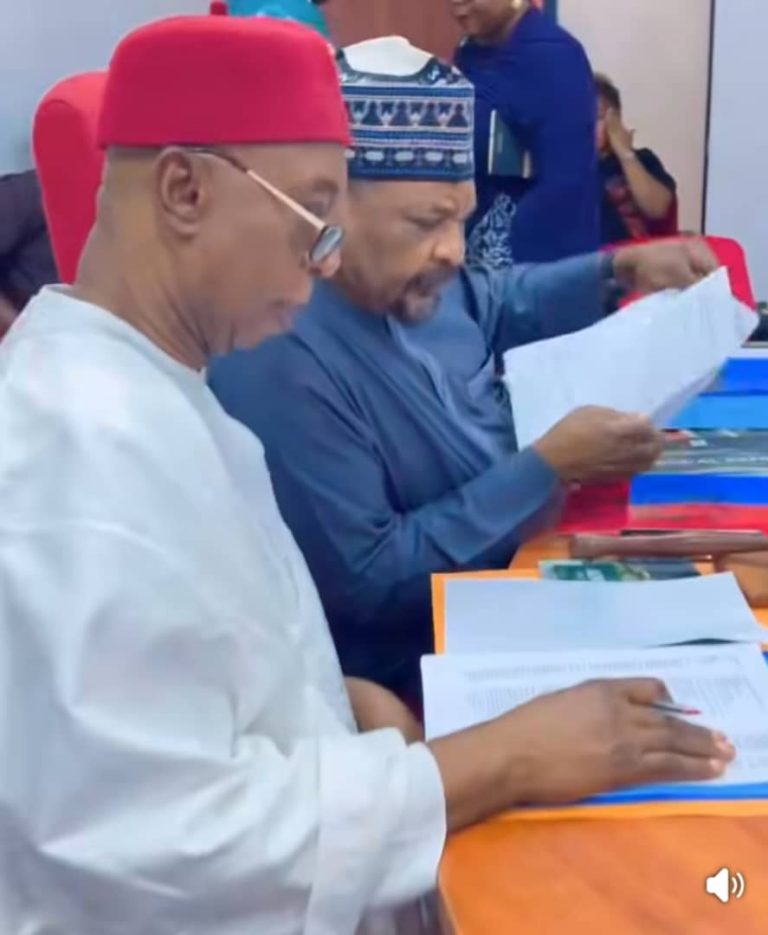

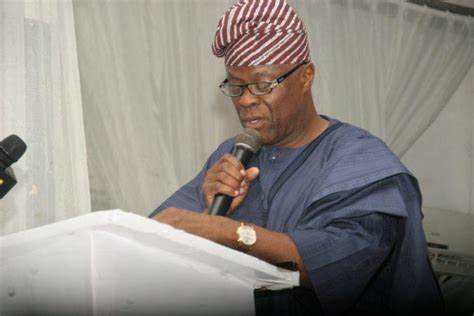

Minister of Finance and coordinating minister of the economy, Wale Edun, had at the end of a recent federal executive council meeting, said that the federal government plans to borrow from the pension fund and other locally available resources for infrastructure development in the country.

He said they are focused on tapping into domestic financial resources, particularly pension and life insurance funds, to leverage local funds for national growth.

Following the controversy that trailed the disclosure, Wale Edun has now made a clarification, saying the federal government has no intention to violate the pension fund regulations.

He said;

“It has come to my notice that stories are making around that the federal government plans to illegally access the hard-earned savings and pension contributions of workers.

“Nothing could be further from the truth. The pension industry, like most of the financial industry, is highly regulated. There are rules, and limitations about what pension money can be invested in and what cannot be invested in.

“The federal government has no intentions whatsoever to go beyond those limits or go outside those bounds which are there to safeguard the pension of workers.

“What was announced to the Federal Executive Council (FEC) – merely for noting, no approval was sought for, or any action whatsoever – was that there was an ongoing initiative, drawing in all the major stakeholders in the long-term savings industry, those that handle funds and are available over a long period.

“To see how within the regulations and laws, these funds could be used maximally, most effectively to drive investment in key growth areas, infrastructure, housing, and of course, to find a way to provide Nigerians with affordable mortgages.

“Within this context, there is no attempt or no consideration to provide less safe investments for pension funds or even insurance funds or any investment funds that are made available.

“No attempt whatsoever to increase the risk, to lower the returns that would otherwise be earned.

“We must remember that the federal government possesses the ability to provide guarantees where stocks are needed to unlock funding that will lead to growth, the creation of jobs and the alleviation of poverty.

“The initiative is an ongoing conversation, a challenge, a test for the best and the brightest in the financial industry to come up with solutions that whilst safeguarding the long-term savings, we do provide an avenue that can help the economy”.

Nigeria’s total pension fund assets stood at N19.6 trillion as of March.