Nigeria’s foreign reserves surged to $40.08 billion on November 7, 2024, marking their highest level in almost two years, as reported by the Central Bank of Nigeria (CBN). This increase reflects a $1.7 billion growth since the end of September, when reserves were at $38.3 billion. The rise is attributed to CBN’s policies encouraging foreign currency inflows through formal channels and remittance-targeted reforms.

The CBN’s recent efforts to engage International Money Transfer Operators (IMTOs) and the Nigerian diaspora have been critical to this recovery. Earlier in 2024, reserves had dipped below $34 billion due to foreign exchange pressures and global oil market volatility. However, sustained growth from $33.7 billion in June to the current $40.08 billion highlights the CBN’s successful policy interventions, aimed at stabilizing the naira and enhancing foreign currency inflows.

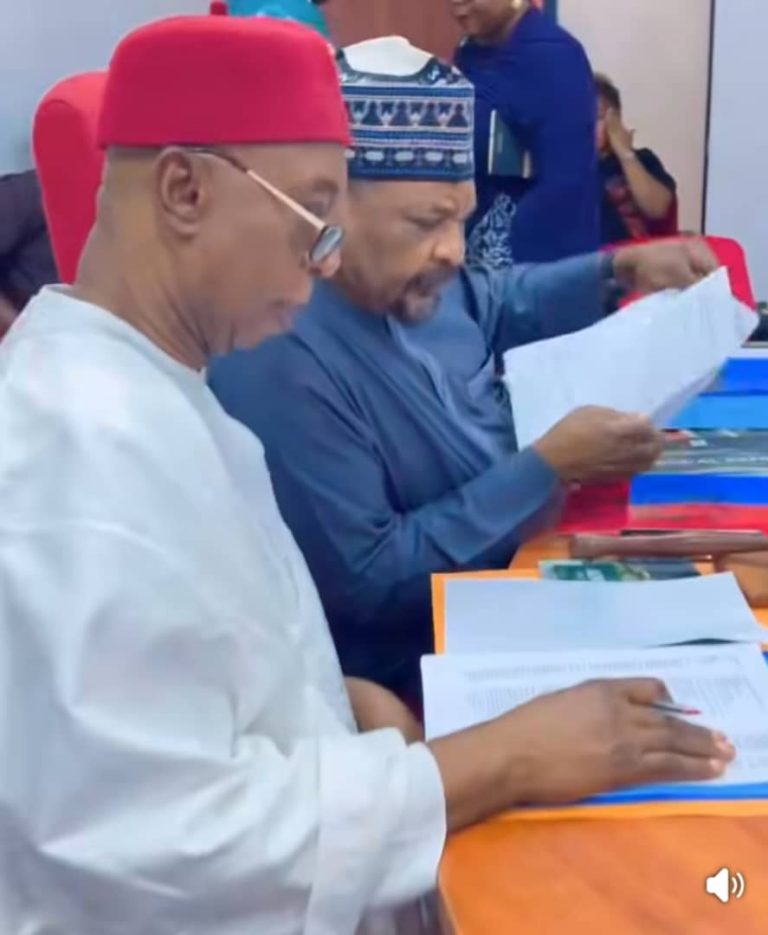

CBN Governor Olayemi Cardoso commented on this progress during a symposium in Abuja, noting that the current reserves level is the highest in nearly three years. “These reforms have started yielding positive results, with notable improvements in the FX market and a stabilization of foreign reserves,” Cardoso stated.

He further emphasized the importance of diaspora engagement at recent IMF and World Bank meetings in Washington, D.C., pointing to diaspora inflows as vital to Nigeria’s remittance recovery. Cardoso explained: “Nigeria has such a strong diaspora community here; in the earlier stages of the reforms, IMTOs were having issues transferring money back to Nigeria, and we felt it was important to engage them, and we did. As a result of that engagement, we identified particular problems, of which a lot of responsibility was shared. Things have since improved because as at the last meetings, which was, I think, April, monthly inflows were about $250 million, but as of September, it had risen to $600 million.”

He added, “With the recent announcement by Nigeria Interbank Settlement Systems (NIBSS) on Bank Verification Number (BVN), and other products that the banking industry is offering, and through engagement with the diaspora, we believe we will be able to move accordingly and again, rising from that engagement, we put our sights on increasing the inflows to $1 billion monthly, and I’m confident that we will get there.”