By Onomiguren Agbamu

Delta State Government says its plan in the 2026 fiscal year is aimed at balancing revenue growth with the citizens welfare in the state.

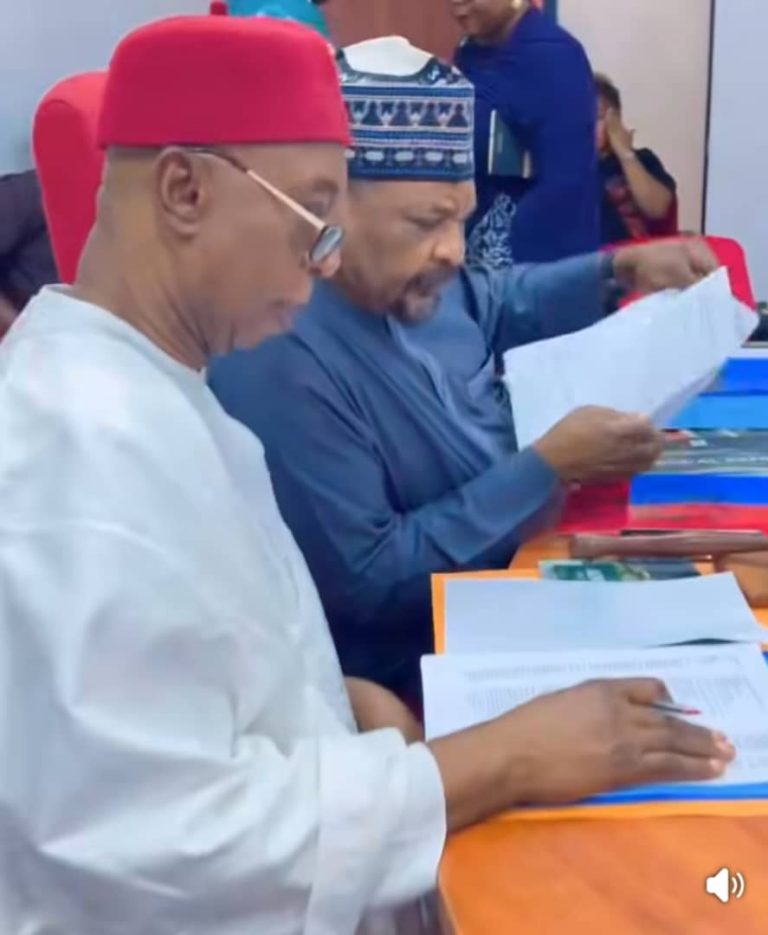

The Commissioner for Finance, Fidelis Tilije, disclosed this during an interview with newsmen after a stakeholders meeting on the proposed amendment to the Delta State Internal Revenue Service Consolidated Law 2020, with all departments of revenue generation in the state following the new tax law to take effect in 2026.

The Commissioner noted that measures are being put in place to boost internally generated revenue that is economically self sustaining for the people of Deltans.

Tilije explained that the stakeholders meeting was in view to see how to generate the funds to service the N1.7 trillion Naira 2026 budget signed into law by the state Governor few days ago.

“What we are trying to do here now is to begin to go to the manufacturing room to try and see how we can generate those funds that will be used to fund the budget for next year.”

“Our IGR has not been to the tune that is expected from the state, because ordinarily, like I keep saying, we want to drive the IGR of Delta State to such a level where we are sure that whether we go to Abuja for FAAC or not, we are able to pay salaries of workers in the state.”

“We also do know that we needed to take cognizance of the new tax law that will come into force by 2nd of January 2026, and so we have been able to plot all those into the platform that we have to enable us know the reduction that we will be having as per the N800,000 Naira ceiling for no taxation.”

” Those reductions in that tax point, we know, will definitely bring some reductions in the total IGR generated by the state. So we are looking at strategies towards ensuring that at the end of the day, those reductions will not impact negatively on Delta State.”

The financial expert, however, appealed to Deltans to continue to maintain the peace existing in their areas for more sustainable development.

He said, “My plea to Deltans is for us to try and do the best that we can to ensure that there is peace in Delta. Because peace actually is the pivot on which development will actually stand at the end of the day.”

“Sometimes the resistance to tax has to do with the non-performance of government.

But we know that Sheriff Oborevwori’s government is doing very well. And because he’s doing very well, we believe that people will be willing to pay taxes.”

Also speaking separately, the Commissioner for Works, Rural Roads, and Public Information, Charles Aniagwu, said the government was harmonizing taxes, blocking leakages, and adopting new modern collection methods to prevent overtaxation. “All is just with a view to ensuring that we are taking the right decisions

that will be good for our people

and serve the interests of governance in our state.”

“In the course of time, a number of tax forces became more like an embarrassment to the state, harassing our citizens; for that reason, these taxes have also been unified in such a way that you will not be having people carrying sticks, which is very primordial.”

“We are also trying to be much more modern in the processes through which these taxes are collected. So we will be collecting taxes that will enable the government to provide good governance, such that companies that are paying these taxes will also survive in our system.”

“What we are doing now is , first,

save the public from that harassment that comes from multiple collections; secondly, we also plead with them to pursue patriotism. In which case, even if somebody doesn’t harass you,

you should be able to know that what you are doing is taxable, and you can willingly pay your tax like some patriotic people do.”