By Onomiguren Agbamu

An end to multiple taxation may soon become a reality as the Internal Revenue Service Consolidated Bill 2026 has passed the second reading on the floor of the Delta State House of Assembly.

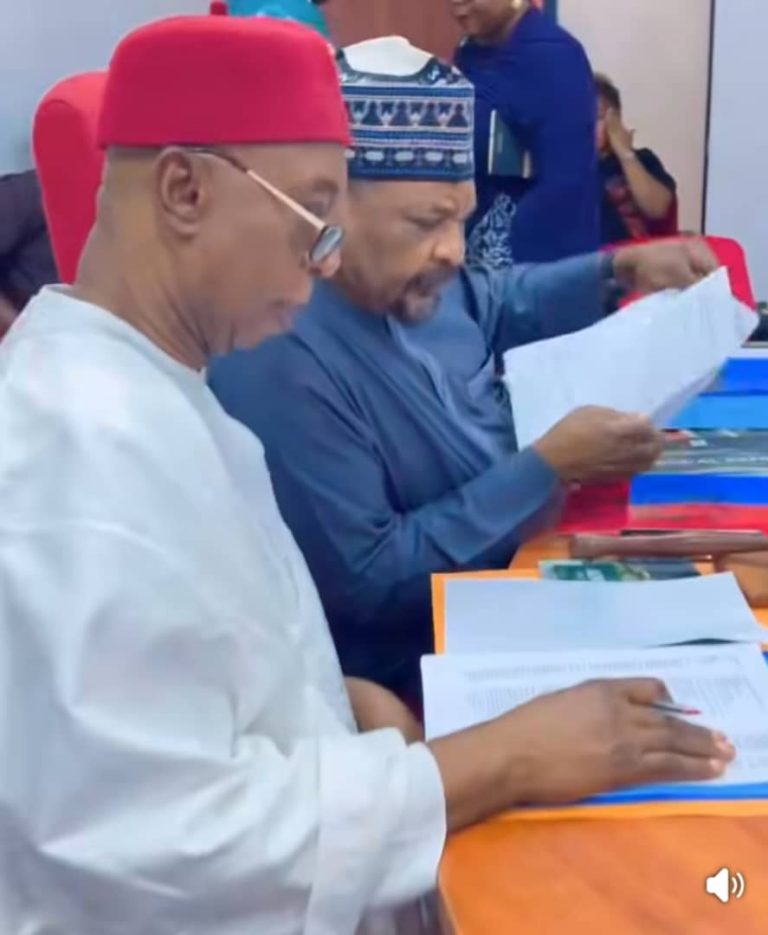

The bill, which seeks to harmonize the payment of taxes and levies across the state, was extensively debated during plenary presided over by the Speaker, Emomotimi Guwor.

Leading the debate, the Leader of the House and member representing Aniocha North Constituency, Emeka Nwaobi, explained that the proposed legislation aims to repeal existing tax laws in Delta State and establish a unified legal framework to regulate tax administration and collection.

Hon. Nwaobi highlighted the seven key components of the bill, noting that when passed, it will align Delta State’s tax system with the new federal tax regime, ensuring proper domestication of the national tax reforms within the state.

Lawmakers who spoke supporting the bill, including the Chief Whip and member representing Sapele Constituency, Perkins Umukoro, Charles Emetulu, Marilyn Okowa-Daramola, James Augoye, and Frank Esenwah, expressed confidence that the bill will boost economic activities, improve Internally Generated Revenue (IGR), and eliminate the burden of multiple taxation through a streamlined and unified system.

The bill subsequently enjoyed unanimous support through a voice vote and was referred by the Speaker to the House Committee on Finance and Appropriation for further legislative scrutiny.

The proposed legislation was earlier transmitted to the Assembly by Governor Sheriff Oborevwori following the coming into effect of the Tax Reform Laws of 2025 and the need to align Delta State revenue laws with the new national tax framework.