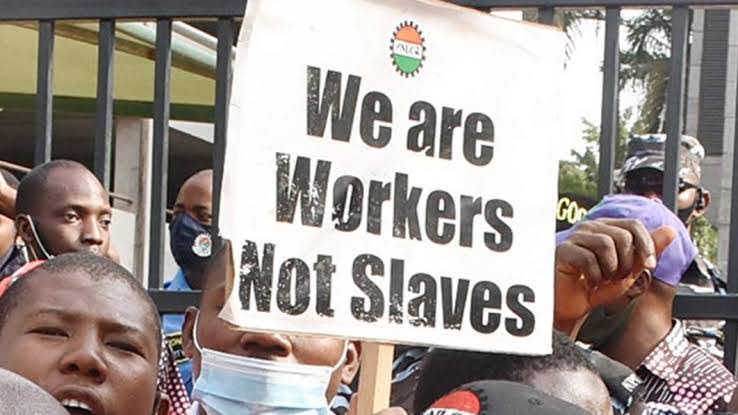

Not every worker will benefit from the new N70,000 minimum wage, according to the Tripartite Committee on the New National Minimum Wage.

After the FG and Organised Labour Unions reached an agreement of N70,000 as the new minimum wage, Senate President Godswill Akpabio announced that the newly approved minimum wage applies to all workers across both public and private sectors, including maids and other domestic staff.

Speaking during the plenary, the Senate President said, “If you are a tailor and you employ additional hands, you cannot pay them below N70,000. If you are a mother with a newborn child and you want to hire a housemaid to look after your child, you cannot pay the person below the approved minimum wage. It is not a maximum wage. It applies to all and sundry.

“If you hire a driver or gateman, you cannot pay them below N70,000.”

However, it appears there are exceptions to this.

Before it ended its work on June 5, 2024, the Tripartite Committee on the New National Minimum Wage recommended the categories of workers who are not eligible to receive the minimum wage.

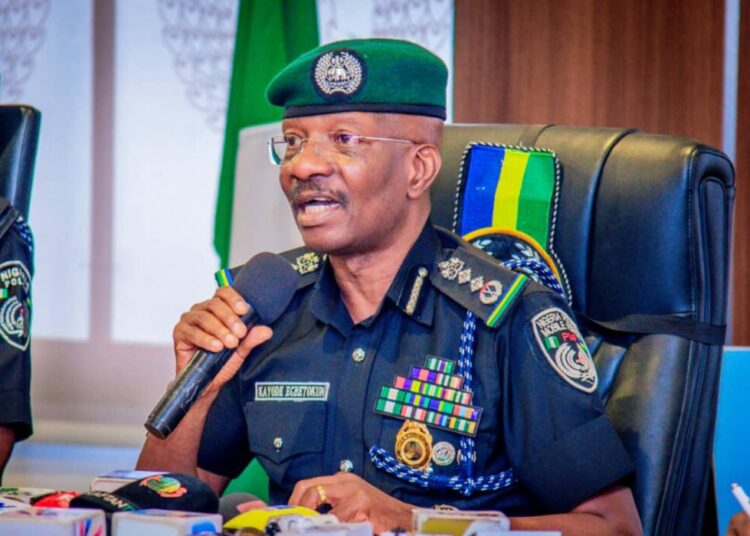

The 10-man sub-committee of the Tripartite committee comprised of the Minister of State for Labour and Employment, Onyejeocha Nkiruka, Governor Mohammed Bago of Niger State, labour leaders, private sector operators, four from National Salaries Incomes and Wages Commission among others.

In a report, the committee recommended employers with a minimum of 10 employees as against the 25 employees contained in the now-repealed 2018 Minimum Wage Act, among other categories of workers exempted from the national minimum wage.

The report reads: “The committee after careful considerations, consultation and survey, including reports of the public hearings, as well as to provide the solution to issues and concerns raised, noted that to avoid unreasonable or unfair exclusion of many poor workers from the right to a decent earning, this sub-committee tried to take a different approach to determine who should be exempted.

“Rather than exemption based on capacity to employ, the exemption should be based on revenue or net income, either quarterly or annually. Enforcement mechanisms should be able to access accounts of employer organisations to determine compliance.

“Rather than focus mainly on monthly salary, which is only applicable to government and organised private sector employment, an hourly, daily and weekly minimum wage should be introduced to establishments or businesses that either pay after work or those that may opt to pay weekly, in addition to monthly payment that’s prevalent in organised private sector and the governments. This will take care of part-time and piece-rate employees.”

The report also recommended the introduction of flexibility to exemption, by making it possible for organisations to be able to apply for exemption. To encourage startups and entrepreneurship, years of starting a business could be factored in.

According to the committee, to qualify for exemption from the mandatory payment of minimum wage, a business must fall under a Nano business(Business managed by 1-3 persons with capital below N50,000) and micro business enterprise, has 10 or a smaller number of employees, startup businesses, legal or statutory exemption and commission contract.

Others include establishments that have less than N50 million in revenue per quarter or N200 million in revenue per annum, organisations with less than 10 staff, establishments of not more than three years in existence, industries which have their staff remuneration and compensation regulated by other Acts of the National Assembly or any other business which the Minister of Labour and Employment or the Executive Chairman of the National Salaries, Incomes and Wages Commission finds to be reasonably justified to be waived or exempted, provided that such waiver shall not be given unless the reason for its application is based on evidence of lower revenue, insolvency, debt crisis or other justification that threaten the existence of the establishment, which shall not apply to governments or their ministries, departments and agencies.

The committee took note of the exemption of workers on seasonal employment such as agricultural farmlands, and the exemption of any person working in a vessel or aircraft to which laws regulating merchant shipping or civil aviation apply.

The committee also noted that “The formal sector wage pattern: governments, corporate organisations and other organised private sector businesses. The wage pattern in this category is mainly every month. Workers and their employers in this category are usually the focus of the national minimum wage laws.

“There is yet, a serious challenge when it comes to coverage of or compliance with, as the case may be, the national minimum wage even amongst this category of employers.

“Therefore, it is difficult to have an accurate assessment of the pattern either because some establishment shortchanges by strategically avoiding the threshold or, in the case of state governments, refusing to comply with the law.”

It pointed out “the informal sector wage pattern, in which workers do not have any earning yardstick, wages in this sector are multi-dimensional. Compensation and remuneration in this category range from commission, to piece-rate.

“Some are paid daily after close of business which might be dependent upon daily sales. Some are employed on apprenticeship, to work and learn, while helping to build or grow the business with the agreement to get settlement by taking a share of the business, becoming partners or receiving settlements after some agreed years.”